25 DAYS OF CPE - Featured Webinars

|

|

|

|

|

NFF4 |

HMBI |

ACAU |

BFTU |

PITR |

DEC 1 | 9AM | 8 CREDITS |

DEC 2 | 9AM | 8 CREDITS |

DEC 3 | 9AM | 8 CREDITS |

DEC 4 | 9AM | 8 CREDITS |

DEC 6 | 9AM | 8 CREDITS |

|

Getting Ready for Busy Season: Key Changes Every Tax Practitioner Should Know (NFF4) |

Surgent's Handbook for Mastering Basis, Distributions, and Loss Limitation Issues for S Corporations, LLCs, and Partnerships (HMBI) |

Annual Accounting and Auditing Update (ACAU) |

The Best Federal Tax Update Course by Surgent (BFTU) |

Preparing Individual Tax Returns for New Staff and Paraprofessionals (PITR) |

$259 $208 |

$259 $208 |

$259 $208 |

$259 $208 |

$259 $208 |

|

|

|

|

|

|

MST4 |

PMI4 |

CRAU |

BITU |

IFCP |

DEC 7 | 1:30PM | 4 CREDITS |

DEC 8 | 1:30PM | 4 CREDITS |

DEC 9 | 9AM | 8 CREDITS |

DEC 10 | 9AM | 8 CREDITS |

DEC 11 | 9AM | 8 CREDITS |

|

The Essential Multistate Tax Update (MST4) |

Select Estate and Life Planning Issues for the Middle-Income Client (PMI4) |

Compilations, Reviews, and Preparations: Engagement Performance and Annual Update (CRAU) |

The Best Individual Income Tax Update Course by Surgent (BITU) |

Surgent's Individual and Financial-Planning Tax Camp (IFCP) |

$139 $112 |

$139 $112 |

$259 $208 |

$259 $208 |

$259 $208 |

|

|

|

|

|

RMD4 |

BFTU |

EXI4 |

ERTW |

NBCT |

DEC 13 | 1:30PM | 4 CREDITS |

DEC 14 | 9AM | 8 CREDITS |

DEC 15 | 1:30PM | 4 CREDITS |

DEC 16 | 9AM | 8 CREDITS |

DEC 17 | 2PM | 2 CREDITS |

|

Required Minimum Distributions: Compliance and Planning (RMD4) |

The Best Federal Tax Update Course by Surgent (BFTU) |

IRS Tax Examinations and Hot Issues (EXI4) |

Form 1040 Return Review Boot Camp for New and Experienced Reviewers (ERTW) |

Nuts & Bolts of Cryptocurrency Taxation (NBCT) |

$139 $112 |

$259 $208 |

$139 $112 |

$259 $208 |

$89 $72 |

|

|

|

|

|

|

|

|

|

|

|

CRAU |

ETPA |

BVA4 |

YET2 |

CNA4 |

DEC 19 | 9AM | 8 CREDITS |

DEC 20 | 9AM | 4 CREDITS |

DEC 21 | 1PM | 4 CREDITS |

DEC 22 | 10AM | 2 CREDITS |

DEC 23 | 1:30PM | 4 CREDITS |

|

Compilations, Reviews, and Preparations: Engagement Performance and Annual Update (CRAU) |

Pennsylvania Ethics for CPAs (ETPA) |

Basics of the Valuation of a Closely Held Business (BVA4) |

2021 Year End Tax Developments and Planning Strategies (YET2) |

The Most Critical Challenges in Not-for-Profit Accounting Today (CNA4) |

$259 $208 |

$139 $112 |

$139 $112 |

$89 $72 |

$139 $112 |

|

|

|

|

|

|

AAUP |

BITU |

ENFP |

TFBC |

ETHC |

DEC 27 | 9AM | 8 CREDITS |

DEC 28 | 10AM | 8 CREDITS |

DEC 29 | 9AM | 8 CREDITS |

DEC 30 | 11:30AM | 8 CREDITS |

DEC 31 | 1:30PM | 4 CREDITS |

|

Financial Reporting Update for Tax Practitioners (AAUP) |

The Best Individual Income Tax Update Course by Surgent (BITU) |

Preparing Not-for-Profit Financial Statements (ENFP) |

Tax Forms Boot Camp: LLCs, Partnerships, and S Corporations (TFBC) |

Ethical Considerations for the CPA (ETHC) |

$259 $208 |

$259 $208 |

$259 $208 |

$259 $208 |

$139 $112 |

|

"Very timely in response to the recent legislation!"

Amy, CPA

"Very informative webinar during an uncertain time. Appreciate the guidance."

Quinn, CPA

"I thought they did a good job laying out the changes and impacts to businesses and individuals."

John, CPA

"The material covered was exactly what I was looking for. There is a lot to cover in 3 hours, but the presenters did an excellent job!"

Dennis, CPA

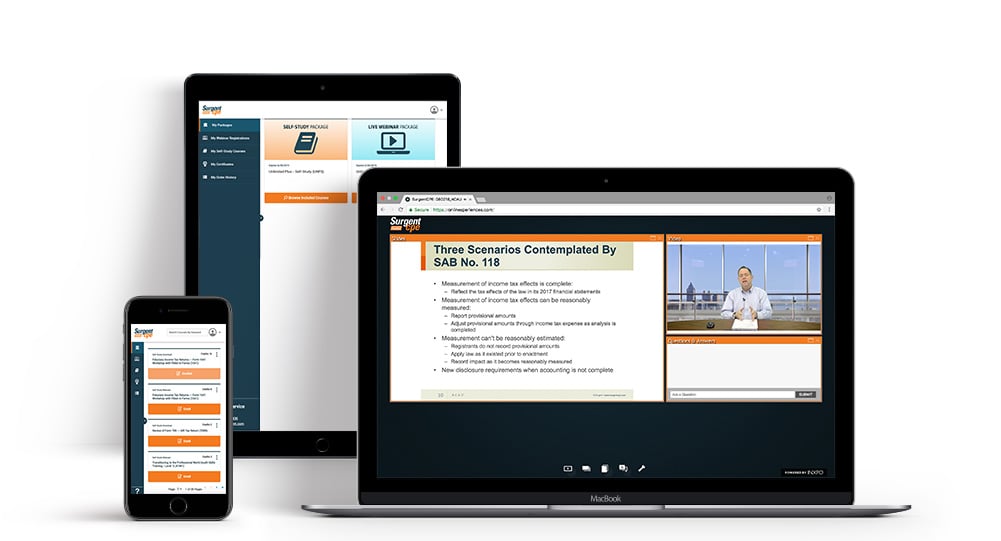

Why Surgent CPE?

Unlimited Plus Package

Package includes 12 months of access to:

- Over 7,500 credits

- 1,200+ live webinars

- 190+ self-study PDF courses

- 100+ on-demand webcasts

- Surgent's exclusive premium courses

Get the best value CPE package on the market. For one low price, enjoy 12 months of access to every Surgent CPE course in every online format--plus unlimited CPE credits! This is the only package that includes premium courses, such as our late-breaking tax updates, specialized courses, and our premium Weekly Expert Hour. Order now for 20% off and you'll receive an email with access instructions to start using your package today.

SURGENT'S 25 DAYS OF CPE

Catch up on all the credits you need with Surgent's live webinars, self-study courses and packages.